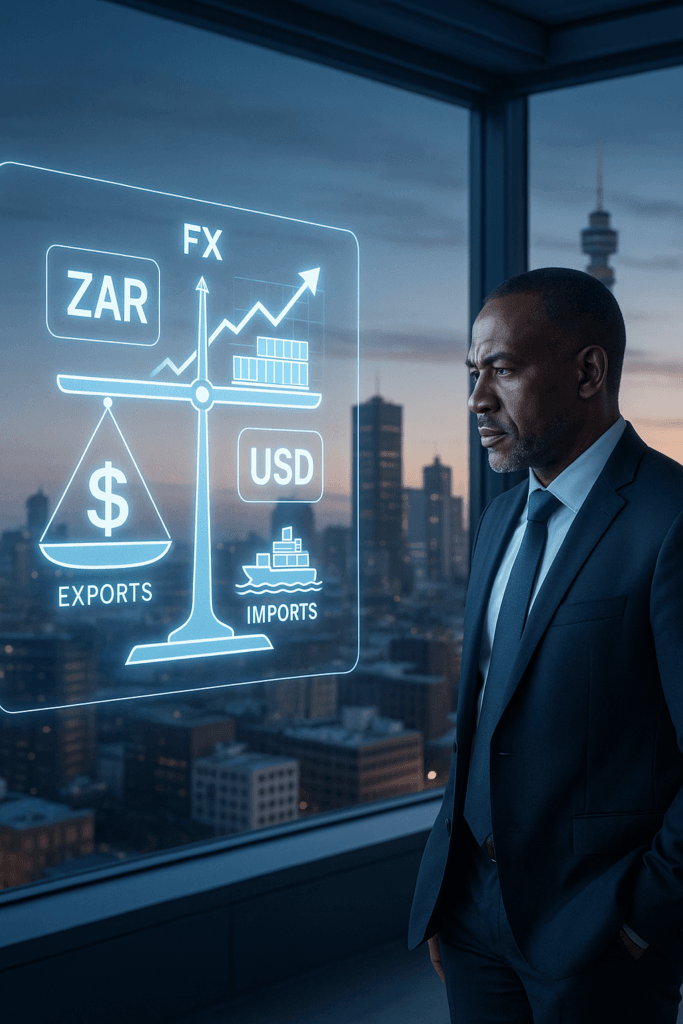

PFS Market Sentiment Podcast – Currency Rally: How the Strong Rand Impacts Your Imports and Exports

The surge in the South African Currency, the Rand, demands immediate attention, especially from those involved in imports and exports. Trading below R17 per US dollar signals structural improvements and fiscal discipline. While a stronger Rand aids imports, it pressures exports. Strategic adjustment is key to managing this shifting trade dynamic.