PFS Market Sentiment Podcast – Foreign Exchange Update: Why a Stronger Rand Matters for South African Importers and Exporters

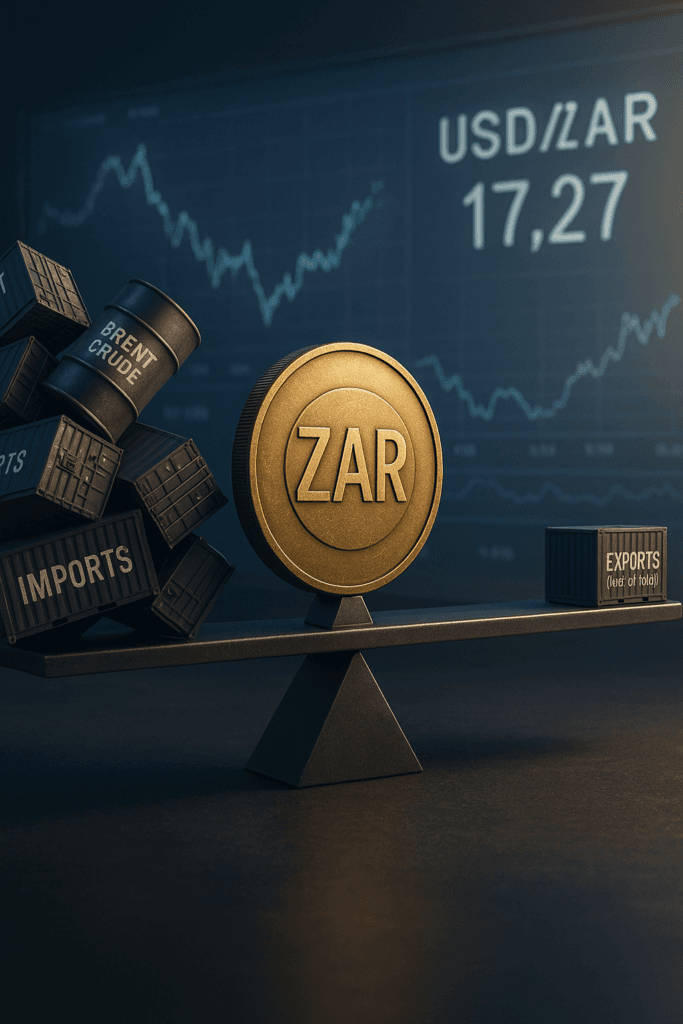

The shifting foreign exchange outlook, driven by expected US rate cuts, has significantly strengthened the rand. This impacts businesses tracking the dollar to rand exchange rate, offering cost advantages for imports while requiring exports companies to immediately adjust pricing strategies for profitability in this strong currency environment.