PFS Market Sentiment podcast – Currency: Navigating Rand and Dollar Volatility for SA Importers and Exporters

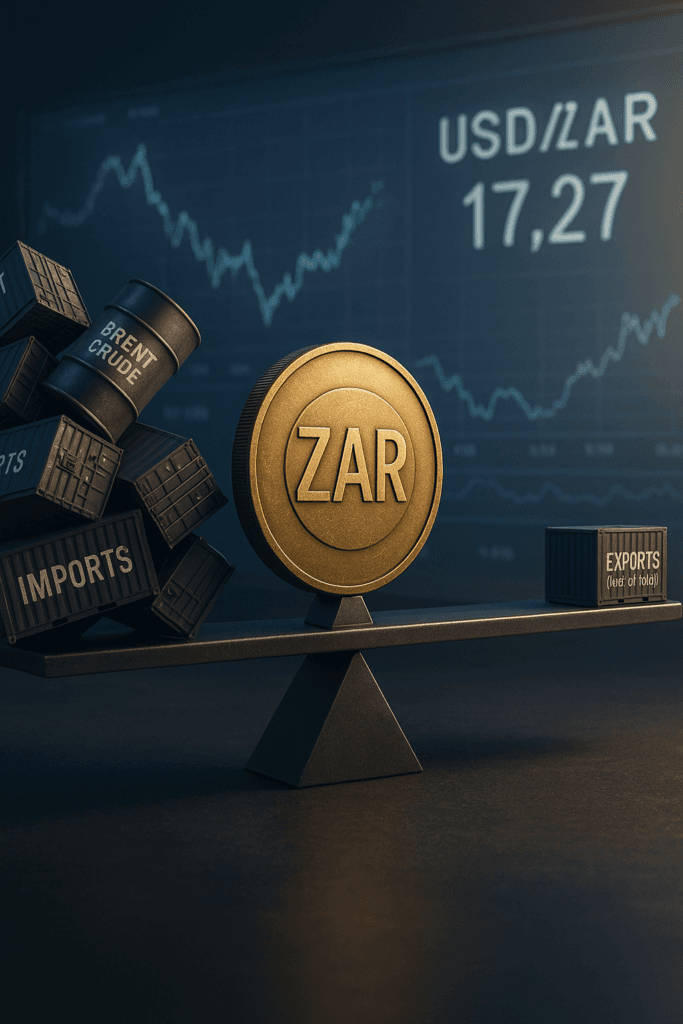

Global Currency volatility, driven by the softer Dollar tone and expected Fed rate cuts, is currently supporting the Rand. This shift offers South African businesses a crucial window to optimize costs for imports and maintain competitive pricing for exports.