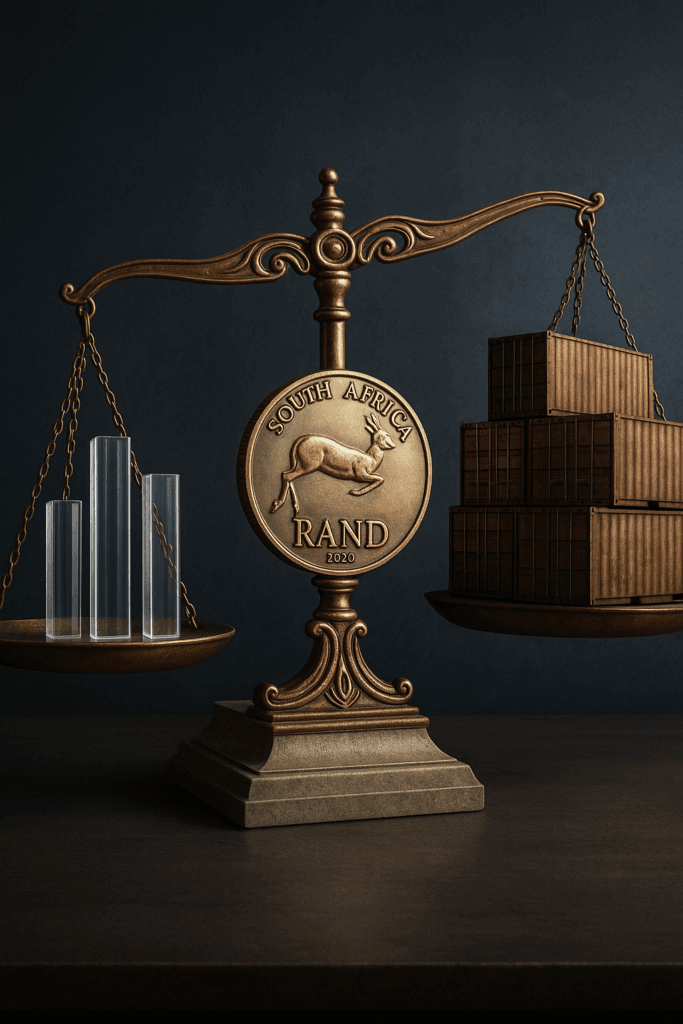

PFS Market Sentiment Podcast – Currency Volatility and the Geopolitical Knot: An Urgent Analysis of the Rand’s Trajectory Against the US Dollar for Imports and Exports

South Africa’s Currency trajectory shows the Rand trading strongly against the US dollar, reflecting a near 10% gain and deeply positive market sentiment. However, persistent threats, including new US tariffs on exports and the critical challenge of accelerating South African GDP growth, require careful financial navigation for all trade-exposed businesses.