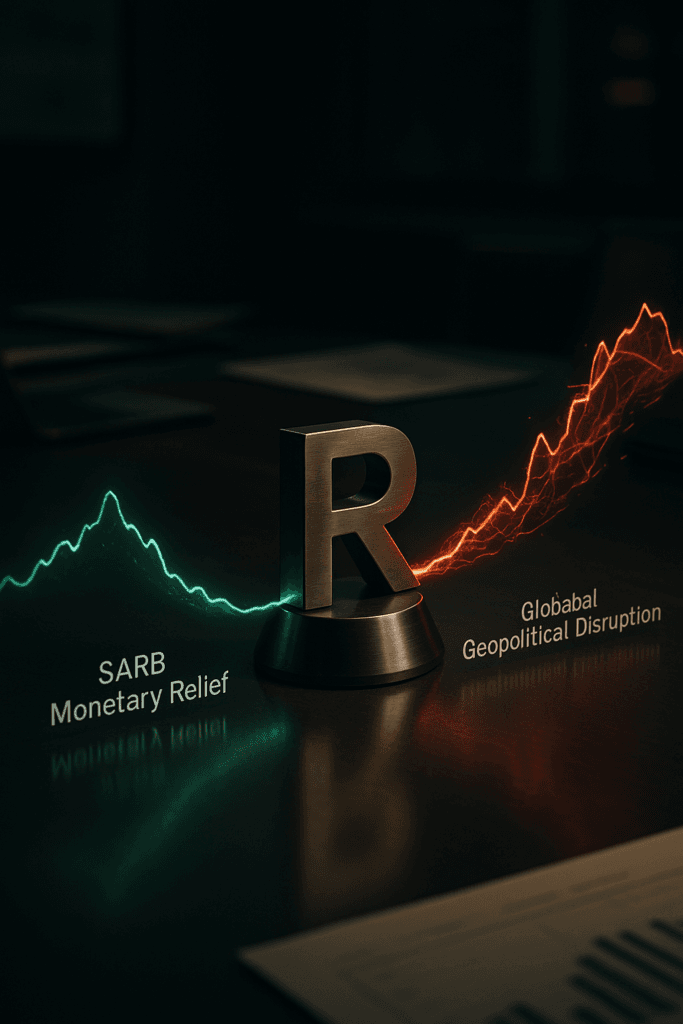

PFS Podcast – US Dollar Resilience: Navigating Rand Volatility, Gold Shifts, and Interest Rates for South African SME Trade

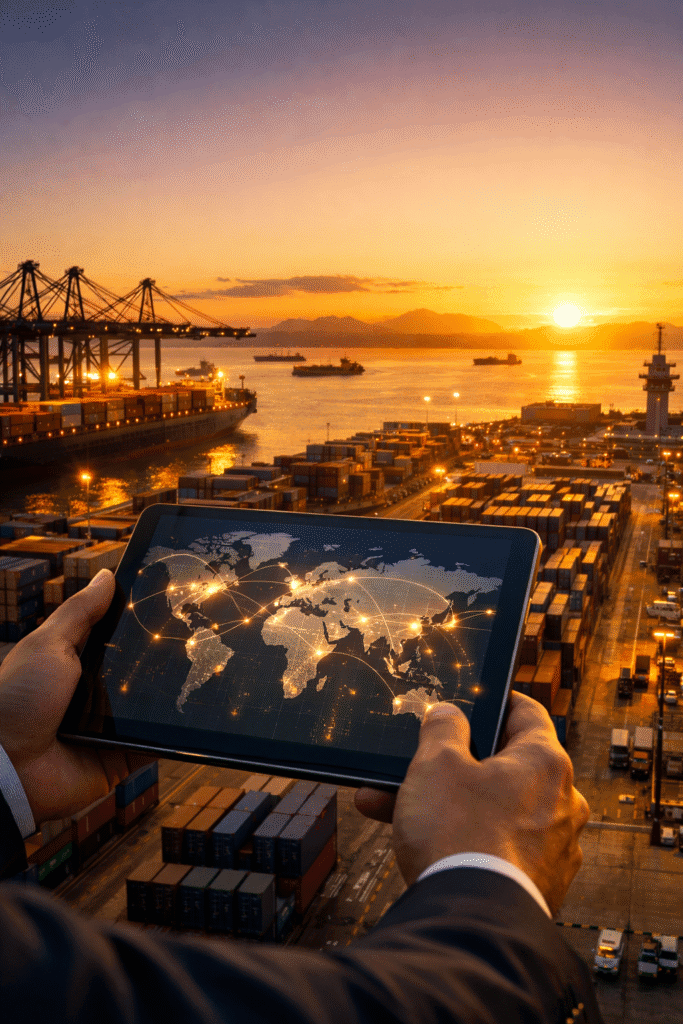

The global landscape is shifting as the US dollar regains its footing, creating fresh headwinds for the rand. Following a sharp correction in gold prices and the SARB’s decision to hold interest rates steady, South African SMEs must navigate a volatile trade environment. Learn why disciplined hedging is essential for protecting your margins.