PFS Podcast – US Dollar Volatility and Record Gold: Navigating the Rand for South African SME Imports and Exports

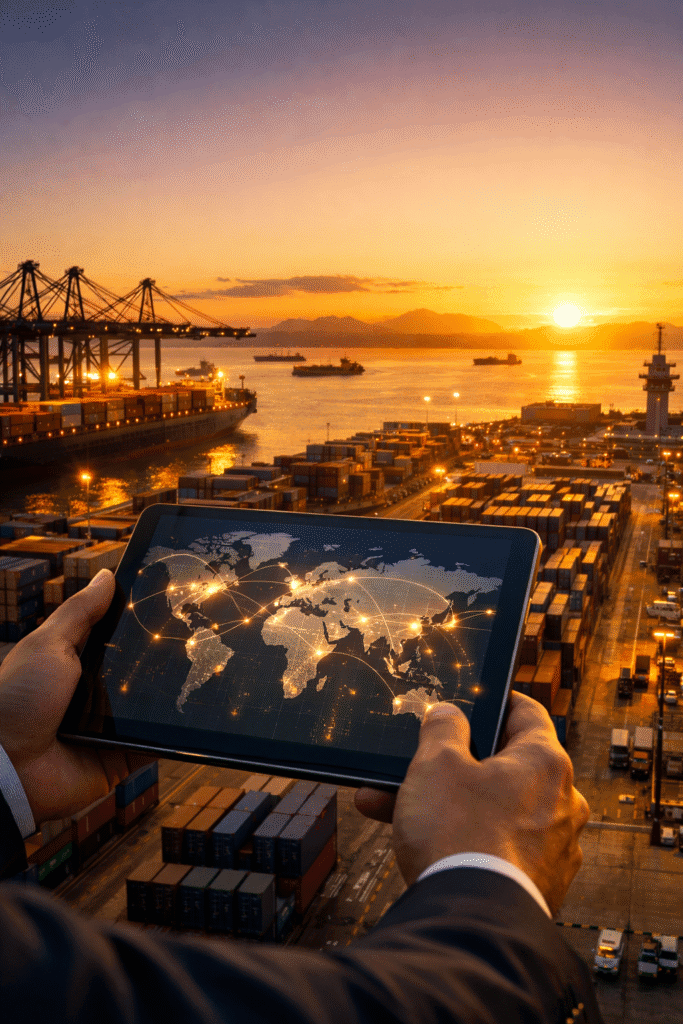

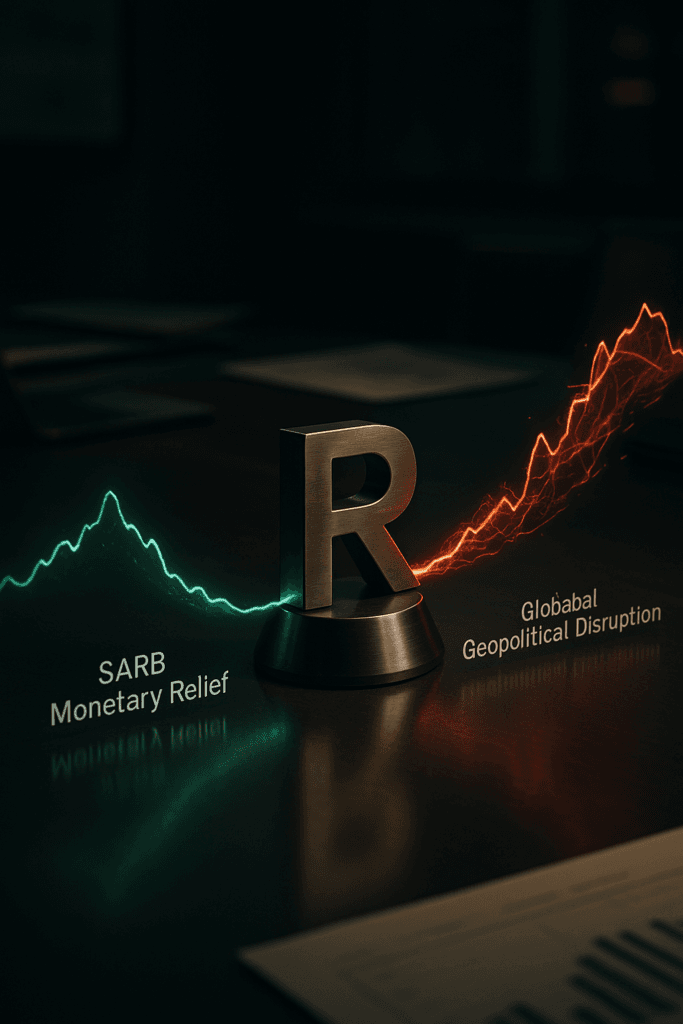

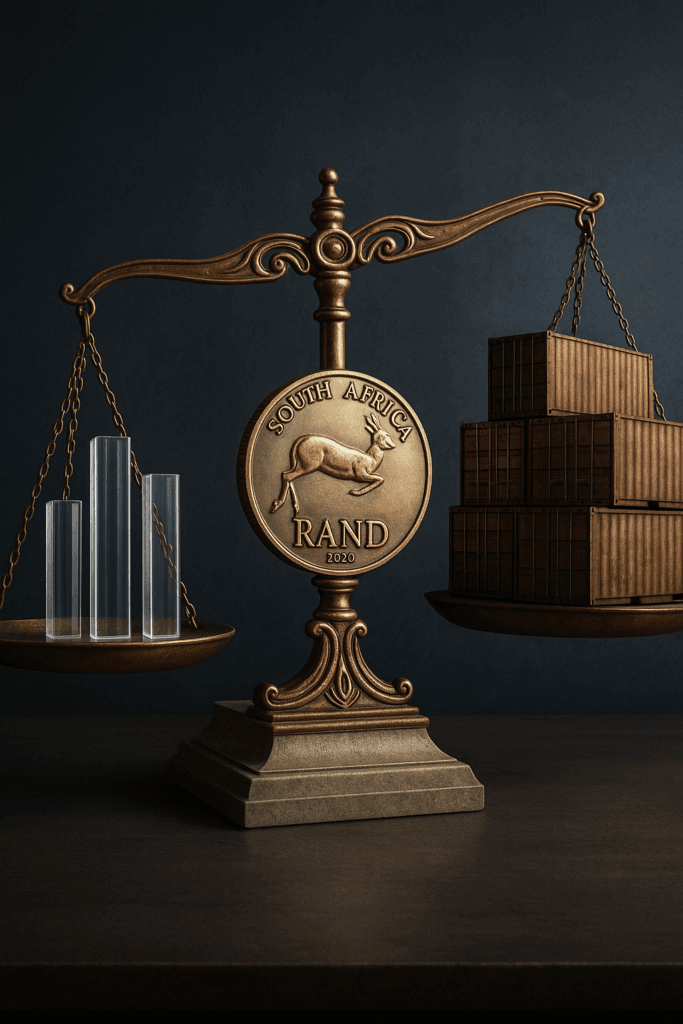

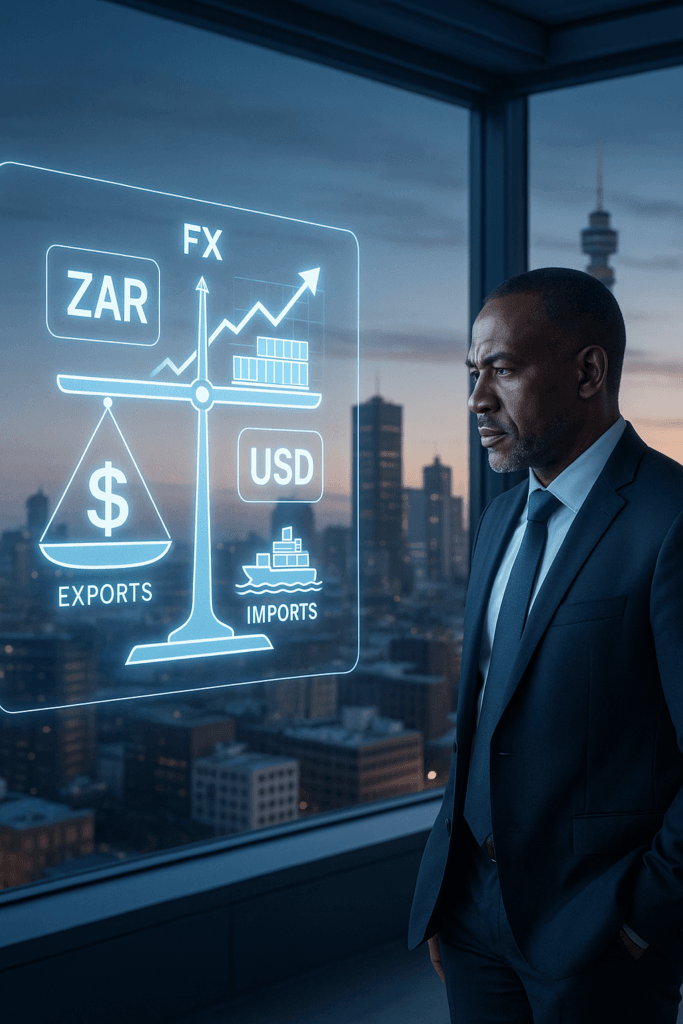

As the US dollar hits four-year lows amid a global “crisis of confidence,” the South African rand has strengthened significantly. This shift provides strategic relief for businesses managing imports, while simultaneously narrowing profit margins for exports. Learn how SMEs can navigate today’s currency volatility with disciplined treasury management.