💹 Major Currency Snapshot:

USDZAR: 17.14

EURZAR: 19.84

GBPZAR: 22.50

Introduction:

The current macroeconomic climate presents South African decision-makers with a complex paradox: domestic Currency dynamics offer marginal relief, yet deep-seated trade vulnerabilities threaten future growth. Our investigation reveals that the immediate strength of the Rand is directly correlated with shifting sentiment regarding the US dollar, driven by expectations that the Federal Reserve will ease rates as the US labor market shows signs of cooling. This external easing provides a necessary, though potentially temporary, buffer. However, the true urgency lies in the trade sector. Despite the formal economy being highly competitive globally, the critical micro, small, and medium enterprise (MSME) sector—which contributes an estimated 35% to South African GDP—is struggling intensely. Crucially, the vital flow of SME exports to key markets remains significantly hampered, still operating 40% below the baseline set before the recent imposition of tariffs, forcing businesses to urgently explore market diversification to mitigate volatile policy risks. Navigating this precarious balance between short-term forex stability and long-term trade fragility requires immediate strategic recalibration.

Key takeaways from sources:

- • Forex Buffer Provided by Easing US Dollar Expectations: The Rand has recently demonstrated marginal stability against major currencies, including the US dollar, the Euro, and the Pound. This stability is primarily external: expectations for a Federal Reserve interest rate cut in December have increased significantly (currently priced near 68%) following softer US jobs data. The easing of the US dollar provides a temporary window of opportunity for ZAR-based businesses by narrowing interest rate differentials, influencing the cost calculation for both imports and exports.

- • Persistent Trade Deficits and Tariff Fallout: Despite showing resilience with a 23% recovery in October, South African SME exports to the United States remain significantly challenged, holding 40% below the baseline set before the imposition of new US tariffs. The sustained impact of US policy decisions, coupled with waning US consumer demand, has made small-parcel exports “far less economical” for specific sectors, with apparel declining 78% and cosmetics falling 80% since April. Diversification into new markets is essential to mitigate continuous policy and market volatility.

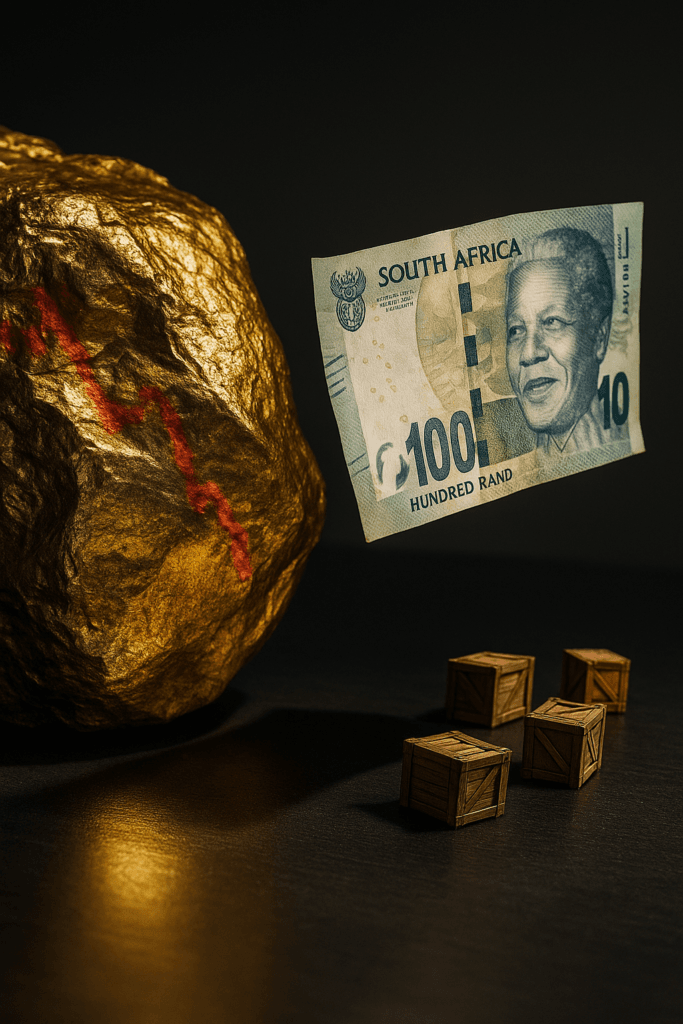

- • Commodity Windfall Masks Structural Weakness: The government is benefiting from a significant fiscal boost, driven by a surge in commodity prices, which includes the near-record high gold price. This commodity bull run, partially linked to global volatility caused by US tariffs, is set to generate a tax windfall possibly between R50 billion and R100 billion. While this improves public finances and raises the odds of a credit-rating upgrade, this short-term boost does not solve the long-term challenge of sustainable growth in South African GDP.

- • MSMEs as the Unstable Engine of Growth: The micro, small, and medium enterprise (MSME) sector is crucial, contributing an estimated 35% to South African GDP and creating roughly 60% of new jobs annually. However, the formal economy is failing the majority, and MSMEs operate in hyper-competitive, saturated markets, with a staggering 70% failing by their fifth year due to financial instability and market weakness. Successful long-term growth and job creation hinge on strategically integrating MSMEs into new value chains, particularly those created by the clean energy transition, to move them away from dependence on saturated markets.

- • Compounding Domestic Risk and Geopolitical Focus: Domestic geopolitical risk is rising, highlighted by a planned national shutdown scheduled for November 21st, coinciding with the G20 summit in Johannesburg. This movement aims to draw international attention to domestic crises by leveraging the high concentration of global leaders and calls on participants to refuse work or spending. This instability presents localized operational and logistical challenges concurrent with intensified security measures surrounding the G20 event.

Need a business partner that can help mitigate exchange rate risk?

Book an appointment with one of our treasury specialists.

If you are not subscribed yet, make sure to do so by clicking HERE and signing up.

Sources referenced:

- https://dailyinvestor.com/south-africa/110041/south-africa-heading-for-national-shutdown/

- https://iol.co.za/business-report/economy/2025-11-11-south-african-smes-show-resilience-with-23-rise-in-us-exports-after-turbulent-september/

- https://iol.co.za/business-report/opinion/2025-11-12-south-africas-economic-lifeline-lies-not-in-giants-but-in-its-grassroots/

- https://www.bloomberg.com/news/articles/2025-11-11/stock-market-today-dow-s-p-live-updates?srnd=homepage-africa

- https://www.moneyweb.co.za/in-depth/budget/godongwanas-mini-budget-will-get-a-commodity-windfall-tax-boost/

- https://www.moneyweb.co.za/news/economy/goldman-sees-sa-ratings-upgrade-this-week-after-budget/

- https://www.zawya.com/en/business/currencies/dollar-eases-as-traders-eye-december-fed-cut-on-weakening-us-jobs-market-rrthkxgr