💹 Major Currency Snapshot:

USDZAR: 17.14

EURZAR: 19.87

GBPZAR: 22.54

Introduction:

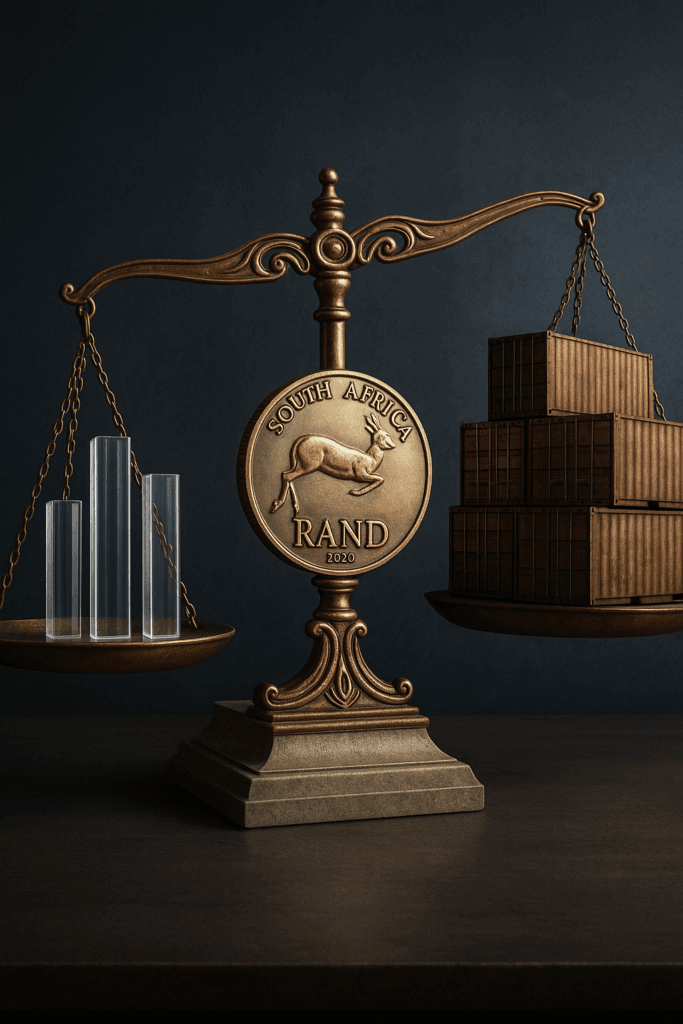

The confluence of strategic domestic policy shifts and persistent global friction has created a critical inflection point in South Africa’s financial markets. For decision-makers focused on managing trade exposure, the dynamics of the national Currency demand an urgent, objective assessment. While the Rand has demonstrated resilience—achieving significant gains against the US dollar due to fiscal consolidation and structural reform commitments—this domestic strength masks deep external vulnerabilities that directly impact imports and exports. Sustaining this fragile confidence requires more than policy signaling; it relies fundamentally on driving measurable long-term acceleration in South African GDP growth, especially in the face of ongoing geopolitical risks that threaten international trade balances. This investigation cuts through the market noise to uncover the true economic anchors determining your forward strategy.

Key takeaways from sources:

- • The Rand’s Fragile Strength vs. Key Currencies: The Rand has demonstrated significant year-to-date resilience, strengthening nearly 10% against the US dollar. While the Currency is currently stable, trading marginally stronger against the Euro and the Pound, this stability is vulnerable. Domestic monetary policy, particularly the timing of interest rate cuts following the new 3% inflation target, is complicated by the cautious stance of the US Federal Reserve, leading to split analyst expectations and potential volatility for the Rand.

- • Geopolitical Friction and Trade Barriers: Despite substantial domestic progress in tackling infrastructure constraints that have previously “hamstrung exports“, global trade flows face direct external risks. The US administration has imposed a 30% import tariff on some South African exports, while trade negotiations aimed at reducing these tariffs remain ongoing. Decision-makers must urgently assess supply chain viability against the backdrop of this escalating friction with the US, which also includes political rhetoric that unnerves some investors.

- • Inflation Targets and Long-Term Stability: The formal adoption of a lower 3% inflation target by the National Treasury provides a credible framework intended to achieve fiscal stabilisation. While this adjustment mechanically raised the debt-to-GDP ratio temporarily, the medium-term benefit is expected to reduce borrowing costs and eventually lead to “permanently lower interest rates”. This fundamental policy shift supports fiscal efforts to place the debt-to-South African GDP ratio on a downward path for the first time in years.

- • Commodity Momentum Underpins Revenue: The current positive sentiment is structurally supported by robust commodity prices, which contribute significantly to the government’s revenue windfall. Specifically, the gold price continues its strong run, currently trading at 4,092 US Dollars per ounce. This commodity momentum has allowed the primary surplus of the main budget to be projected to improve to nearly 1% of South African GDP, providing a buffer for the government to repay debt and bolster fiscal stability.

- • Political Risk Caps Investment Growth: Even with a generally positive whisper permeating the market—driven by structural reforms and the end of loadshedding—political risks persist. Speculation concerning the stability of the national coalition and potential attempts to remove President Ramaphosa early continues to weigh on domestic assets, keeping some local stocks “relatively cheap”. This lingering uncertainty deters the swift investment surge needed to achieve the 2% economic growth forecast by Moody’s as necessary for sustaining fiscal progress.

Need a business partner that can help mitigate exchange rate risk?

Book an appointment with one of our treasury specialists.

If you are not subscribed yet, make sure to do so by clicking HERE and signing up.

Sources referenced:

- https://dailyinvestor.com/south-africa/111136/south-africa-in-the-middle-of-a-storm/

- https://dailyinvestor.com/banking/111121/top-bankers-bet-south-africa-has-turned-the-corner/

- https://dailyinvestor.com/finance/110862/interest-rate-cut-coming-for-south-africa/

- https://businesstech.co.za/news/finance/843680/good-news-about-interest-rate-cuts-this-week/

- https://iol.co.za/business-report/companies/2025-11-18-revenue-gains-lower-inflation-target-bolster-fiscal-outlook-but-spending-pressures-loom-moodys/

- https://www.moneyweb.co.za/news/economy/south-africa-awaits-last-rate-decision-of-2025/

- https://www.dailymaverick.co.za/article/2025-11-18-sa-inc-and-the-hint-of-positive-whisper/?dm_source=dm_block_grid&dm_medium=card_link&dm_campaign=main

- https://www.reuters.com/world/china/global-markets-view-europe-2025-11-19/

- https://www.reuters.com/world/china/foreign-demand-us-treasuries-slips-september-japan-steps-up-buying-2025-11-18/