💹 Major Currency Snapshot:

USDZAR: 17.32

EURZAR: 19.94

GBPZAR: 22.67

Introduction:

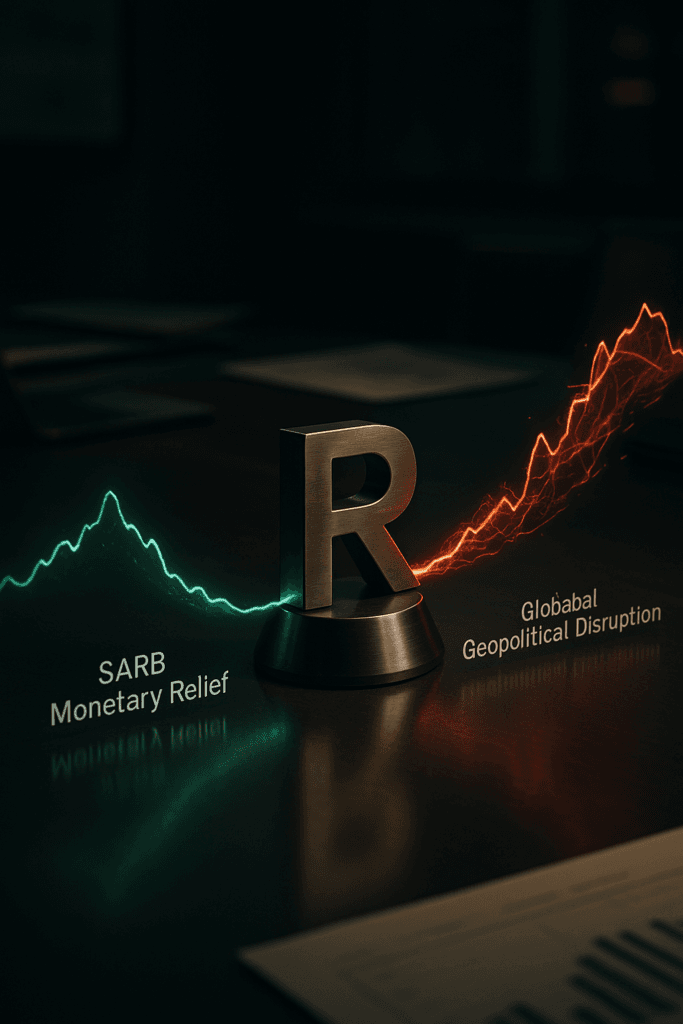

The current global financial landscape presents a complex duality for South African trade-focused businesses: domestic monetary relief coupled with intense international turbulence. The core market theme centers on how localized adjustments in monetary policy interact with major geopolitical ruptures.

For decision-makers navigating cross-border trade, understanding the interplay between domestic policy and external pressures is paramount. While the South African economy recently benefited from a welcomed reduction in the interest rate, easing debt burdens for businesses, this relief coincides with profound instability in the currency and trade environments. The immediate market reaction saw the rand depreciate following the rate cut, though it has since shown resilience against the US dollar. Crucially, global international relations are suffering deep ruptures driven by aggressive tariff actions by major powers, disrupting commerce in a way not seen in eight decades. However, the good news is that Africa’s strong reliance on intra-African and South–South trade, combined with limited exposure to US manufacturing supply chains, has cushioned the continent from the worst impacts of these external trade wars. This structural resilience, coupled with the continued strong performance of commodities like gold—which has helped drive the nation’s robust market returns—provides an essential defensive layer. Therefore, the central challenge for importers and exporters is capitalizing on local financial flexibility while strategically managing the continuing volatility of global trade routes and currency risk.

Key takeaways from sources:

- • Monetary Relief in the South African Economy: The recent 25 basis point cut to the repurchase rate, lowering the prime lending rate to 10.25%, provides tangible financial relief within the South African economy by easing debt pressure. This decision reflects stabilizing inflation and is linked to the highest level of financial confidence reported by South Africans in three years. This local rate environment offers a window for businesses to review borrowing and financial planning, despite initial negative market reactions.

- • Managing Currency Volatility Driven by Interest Rate Expectations: Exporters and importers must remain vigilant regarding the volatile rand. The currency’s performance is influenced by both local and international interest rate expectations. While the rand recently firmed against the US dollar (trading at R17.32/$), it initially depreciated following the domestic rate cut and global risk-off sentiment last week. Traders are currently anticipating potential Federal Reserve rate cuts next month, a global monetary signal that will continue to dictate short-term dollar strength and, consequently, the rand’s valuation.

- • Structural Resilience Amidst Ruptured International Relations: Despite “deep ruptures” in the global trading system caused by aggressive U.S. tariff actions and escalating geopolitical tensions, Africa’s trade has shown resilience. For SMEs, this means prioritizing diversified markets: Africa’s limited exposure to US manufacturing supply chains, combined with its strong reliance on intra-African and South–South trade, has helped cushion it from external trade wars. The continent’s key challenge remains reducing the high cost of intra-African trade, which is 20% more expensive than trading with the outside world.

- • Commodity Strength Offers Economic Support: The structural demand for gold remains robust, driven by persistent geopolitical tension and fiscal risks, leading UBS to forecast prices potentially reaching $4,500 per ounce by mid-2026. Elevated prices for precious metals like gold and platinum have been primarily responsible for the South African economy‘s strong market return over the past year. This commodity strength provides underlying support to the nation’s financial outlook.

- • Divergent Energy Trends and Cost Management: In contrast to buoyant precious metals, global oil markets have shown a recent slip, with Brent crude futures declining. Lower energy prices are expected by some US officials to drive down broader inflation. For importers, a softening oil price can help mitigate logistics and operating costs, providing a counterweight to potential currency weakness.

- • Global Splintering Requires Strategic Market Coordination: The global order is reorganizing itself, evidenced by major powers clustering and engaging in complex bilateral negotiations that factor in trade, security, and critical minerals. In response, emerging economies like India, Brazil, and South Africa are reviving coordination forums like IBSA to push back against aggressive trade policies and coordinate on development issues. This geopolitical context underscores the necessity for SMEs to utilize regional partnerships and diversification strategies to navigate a complex, fragmented global trade environment.

Need a business partner that can help mitigate exchange rate risk?

Book an appointment with one of our treasury specialists.

If you are not subscribed yet, make sure to do so by clicking HERE and signing up.

Sources referenced:

- https://dailyinvestor.com/finance/111934/great-news-about-south-african-consumers-with-a-catch/

- https://businesstech.co.za/news/finance/844128/south-africa-quietly-emerges-as-one-of-the-best-markets-in-the-world/

- https://iol.co.za/business-report/companies/2025-11-23-us-tariff-war-has-rattled-global-commerce-but-africas-trade-remains-resilient-says-wto-chief/

- https://iol.co.za/business-report/opinion/2025-11-24-lower-repo-rate-is-bad-for-markets-for-now-says-chris-harmse/

- https://www.moneyweb.co.za/news/south-africa/trump-turns-g20-into-a-tale-of-two-summits/

- https://www.moneyweb.co.za/news/international/trumps-attacks-push-india-brazil-and-sa-closer-together/

- https://www.zawya.com/en/economy/global/no-recession-risk-for-us-economy-as-a-whole-after-11bln-shutdown-hit-bessent-says-w5rvkwo0

- https://www.zawya.com/en/business/currencies/dollar-steady-thanksgiving-looms-as-yen-test-kphor778

- https://www.reuters.com/world/china/global-markets-pix-2025-11-24/

- https://www.exchangerates.org.uk/news/44621/ubs-gold-price-forecast-2025-2026-gold-holds-above-4000-further-gains-expected.html