💹 Major Currency Snapshot:

USDZAR: 17.07

EURZAR: 19.87

GBPZAR: 22.44

Introduction:

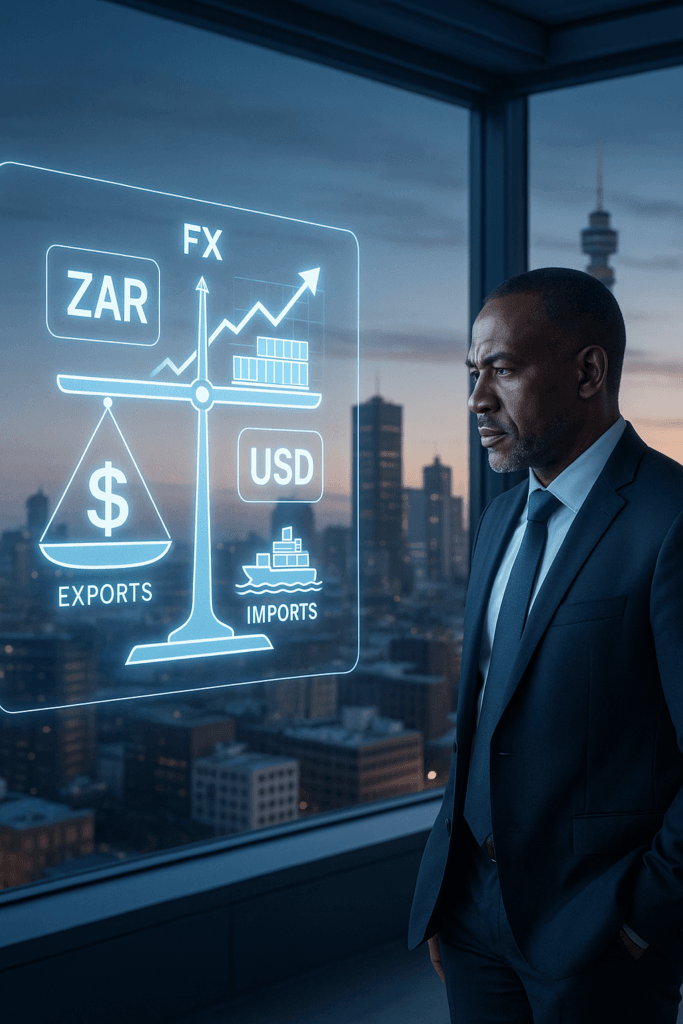

The South African Currency, the Rand, has demonstrated remarkable resilience and strength, recently firming against major global units and trading below R17 per US dollar for the first time since early 2023. For business owners operating in the trade sector, this Currency rally is not merely a headline but a critical factor shaping operational costs and revenue. This significant market theme is driven by a potent mix of improved local fiscal discipline, the official adoption of a lower 3% inflation target aimed at strengthening monetary policy credibility, and positive global sentiment. While a stronger Rand offers a cost advantage for businesses relying on imports, it simultaneously pressures margins for exports, especially since raw materials still account for over half of South Africa’s export earnings. Understanding the drivers behind this strength—including the prospect of monetary policy divergence between the South African Reserve Bank and the Federal Reserve—is essential for decision-makers as they navigate their exposure to the dynamic US dollar exchange rate and plan for long-term growth.

Key takeaways from sources:

- • Stronger Rand (Currency) Shifts Trade Dynamics: The Rand has strengthened significantly, dropping below R17 per US dollar for the first time since February 2023, and gaining ground against major units like the Euro and the Pound. This means that while your imports become cheaper due to favorable exchange rates, your exports face increased margin pressure, requiring careful hedging and costing strategies.

- • Monetary Policy Anchors Future Lending Rates: The government’s official adoption of a lower inflation target (3%, down from the previous 3–6% range) represents a “significant structural shift” aimed at strengthening monetary policy credibility. This commitment is expected to translate into lower inflation expectations and, ultimately, lower lending rates, which should boost business confidence and influence the planning of investment projects.

- • Commodities and US Dollar Divergence Support the Rand: The Currency‘s strength is heavily supported by elevated precious-metal prices, as raw materials account for over half of South Africa’s export earnings (e.g., the gold price remains well-supported, having recently soared above $4,000 an ounce). Furthermore, the prospect of monetary policy divergence between the South African Reserve Bank (SARB) and the US Federal Reserve is a major driving factor for the Rand‘s improved position.

- • Structural Reforms Boost South African GDP Outlook: Investor confidence is fueled by the commitment to structural reforms, fiscal discipline, and the optimistic forecast for South African GDP growth, which S&P expects to average 1.5% y/y for 2025–2028 and ramp up toward 2.0% y/y in the medium-term. This growth outlook is critically dependent on addressing infrastructure pressures and reducing the domestic freight crisis, which will improve the efficiency of your trade operations.

Need a business partner that can help mitigate exchange rate risk?

Book an appointment with one of our treasury specialists.

If you are not subscribed yet, make sure to do so by clicking HERE and signing up.

Sources referenced:

- https://dailyinvestor.com/investing/110414/money-flooding-into-south-african-assets/

- https://businesstech.co.za/news/finance/843051/rand-breaks-through-r17-to-the-dollar/

- https://iol.co.za/business-report/economy/2025-11-14-experts-tip-25bps-rate-cut-as-sarb-readies-for-final-monetary-policy-meeting-of-2025/

- https://tradingeconomics.com/south-africa/government-bond-yield/news/501857

- https://www.reuters.com/world/china/global-markets-view-europe-2025-11-14/

- https://www.wsj.com/finance/stocks/investors-dump-tech-shares-as-shutdown-relief-evaporates-38d34928?mod=hp_lead_pos1