💹 Major Currency Snapshot:

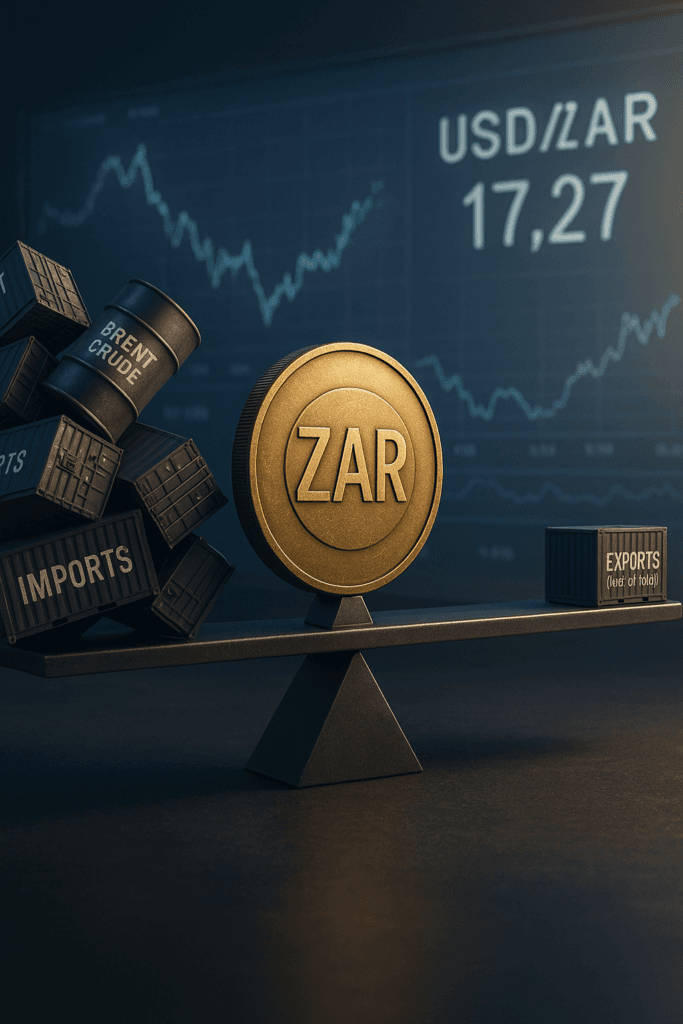

USDZAR: 17.27

EURZAR: 20.24

GBPZAR: 23.21

Introduction:

The South African economy is currently navigating a complex landscape defined by intense trade pressures and global market volatility. While the local automotive industry remains one of the cornerstones of the country, contributing more than 5.2% to the national SA GDP, the stability of this foundation is under significant strain. For business owners in the trade sector, we are operating in a contradictory environment: vehicle and component exports still equate to 15% of South Africa’s total outbound trade, yet local leaders lament that the market is being “flooded with imports“, a trend criticized for resulting in job losses and risking de-industrialization.

Sustaining competitive margins requires vigilant attention to external forces that impact operational costs and transactional stability. Domestically, the recent, albeit marginal, strengthening of the Rand against major currencies provides a small reprieve, but this must be balanced against persistent risks. Globally, the cost of crucial inputs remains unpredictable, notably the price of brent crude oil prices, which are highly sensitive to geopolitical tensions and uncertain production shifts by OPEC+. Understanding the friction between rising imports and essential exports, alongside the volatility in the Rand and commodity costs, is critical for decision-makers aiming for sustained growth.

Key takeaways from sources:

- 1. Protectionist Pressure on Local Production and SA GDP

- The contribution of key manufacturing sectors, such as the automotive industry (contributing over 5.2% to SA GDP), is severely threatened by intense competition from imports. While vehicle and component exports remain a significant part of total trade (15% of total exports), the market is being “flooded with imports“. This trade dynamic is leading to job losses and has drawn sharp criticism that government policy has been distorted in favor of importers and traders. SME owners reliant on the local supply chain should track whether government commitments to transition foreign SKD assembly operations into full CKD manufacturing will materialize, as this is positioned as a key strategy to strengthen the industrial base.

- 2. Currency Movement and Hedging Incentives

- The Rand is currently showing modest strength, marginally firmer across major exchanges. This provides a brief moment of stability for businesses trading internationally. Recent snapshots show the currency pairs standing at: one US Dollar to Rand at 17 Rand and 27 cents, one Euro to Rand at 20 Rand and 24 cents, and one British Pound to Rand at 23 Rand and 21 cents. Simultaneously, the resumption of rate cuts by the US Federal Reserve is expected to cheapen the cost of hedging Dollar to Rand exposure for foreign investors, a development that could signal additional potential weakness for the Dollar and influence future exchange rate stability.

- 3. Heightened Volatility in Brent Crude Oil Prices

- Operational costs related to transport and manufacturing inputs remain highly susceptible to global commodity volatility. Brent crude oil prices were recently priced around $65.81 per barrel. The international drivers influencing crude oil—including the unwinding of OPEC+ production cuts, China’s opaque storage flows, and geopolitical tensions—are all inherently unpredictable. Market forecasting is challenging because these three primary factors often work in opposite directions, leading to price uncertainty. SME decision-makers should model for potential volatility rather than relying on narrow price ranges.

- 4. Policy Focus: Supporting Local Manufacturing and Addressing Infrastructure

- Government officials have committed to implementing strategies that promote local manufacturing and drive meaningful localization. A key initiative is the ongoing discussion to convert existing SKD (Semi-Knocked Down) operations by Chinese and Indian manufacturers into CKD (Complete Knocked Down) manufacturing, requiring local labor to assemble vehicles entirely from parts. However, this policy push is hampered by severe local challenges: stakeholders are actively criticizing core services, noting that ailing road infrastructure, unreliable water and electricity supply, and security concerns are jeopardizing the attractiveness of key industrial hubs to global investors.

Need a business partner that can help mitigate exchange rate risk?

Book an appointment with one of our treasury specialists.

If you are not subscribed yet, make sure to do so by clicking HERE and signing up.

Sources referenced:

- Imports, failing infrastructure and ‘government indecision’ threaten SA automotive industry

- Chinese and Indian carmakers coming to South Africa’s rescue – Daily Investor

- Foreign investors can exploit cheaper dollar hedges as Fed easing resumes

- OPEC, China and geopolitics are the triple whammy of uncertainty for crude | Reuters

- Latest Oil Market News and Analysis for Oct. 3 – Bloomberg